Why Haven't We Settled on the Crypto Planet at Scale Yet?

In September 2023, Matt Huang’s article, “Casino on Mars,” reignited hope amidst the prolonged crypto winter. He likened crypto to a new planet being settled, urging us to see beyond the chaos and recognize the immense potential for growth and future development. Huang also offered a balanced analysis of the speculative behavior in the crypto casino, acknowledging the dark side—the existence of fraud, scams, and other malicious activities. His words served as a much-needed jolt of optimism for a community mired in doubt and despair.

By 2024, crypto experienced several pivotal moments in its history: the U.S. Securities and Exchange Commission (SEC) approved spot ETFs for both BTC and ETH successively; the U.S. House of Representatives passed the FIT21 Act, officially establishing a regulatory framework for digital assets; and BTC experienced its fourth halving, among other significant events. These positive developments combined to spark a modest market rally.

However, the market remained highly volatile, with speculative trading rampant, Ponzi schemes and rug pulls persisting, and hacks and scams continuing to plague the ecosystem. Where was the innovation that would truly push the boundaries? At least during the last hype cycle, we saw the birth of of DeFi and NFTs. But this time? Is it just about meme coins and inscriptions? Why does it feel like the sense of value is diminishing, even giving rise to a sense of “crypto shame”? Are we truly making meaningful strides toward the ideal future we envision?

As I write this preface, nearly a year has passed since the publication of “Casino on Mars,” and the market seems to have once again entered a similar period of silence. Recently, a “self-reflective” post on X by Péter Szilágyi sparked an industry-wide debate about the meaning of crypto’s existence. He bluntly stated: “It’s past time this industry creates something genuinely useful that people want to use, or it should just close up shop.”

While he also believes that many great things are being created, the objective truth we must acknowledge is that, looking down on this planet, we still have not established a thriving crypto civilization. If blockchains are akin to city infrastructure and smart contracts to the buildings within these cities, then, quite frankly, much of this planet remains undeveloped wasteland. Even the cities under construction are riddled with ruins and unfinished projects. The cities that do function are still propped up by long-established structures like MakerDAO, AAVE, Compound, and Uniswap.

Sure, there are many flashy, high-profile projects underway, but how many of them will stand the test of time, human nature, and market forces to become truly meaningful landmarks? Why can’t we build skyscrapers? What gives us the right to think we can attract the next billion users? Where exactly are we getting stuck in crypto development? Or, to dig even deeper, what is the true nature of this planet we are striving to build?

The approval of spot Bitcoin ETFs through a narrow 3-2 vote by SEC commissioners, the wild market swings, and the emotional rollercoaster of participants all reflect my current thoughts:

The crypto world isn’t just black or white; instead, it exists in a superposition state of “an endless future”, “an open casino”, and “a hotbed for evil”. Depending on where you stand and how you see things, the view of crypto can be starkly different.

A superposition state of “an endless future,” “an open casino,” and “a hotbed for evil”

From a market cap perspective, high-value projects such as Bitcoin, Ethereum and other major protocols contribute over 80% of the total crypto market value, suggesting that the overall market is healthy. Crypto has evolved from being a niche, ignored by many, to a market that once surpassed Apple’s valuation and is now gradually gaining acceptance in mainstream financial markets. If this trend continues, it could very well surpass gold, or even real estate, within the next decade. The rise of decentralized finance (DeFi), the popularity of non-fungible tokens (NFTs), the emergence of digital identities (DIDs), and decentralized autonomous organizations (DAOs), along with the gradual implementation of regulatory measures, all point to the acceleration of the crypto’s “endless future.”

In terms of project numbers in the market, out of the tens of thousands of cryptocurrencies(and counting meme coins, the number surpasses hundreds of thousands), only a few hundred will ultimately have substantial value. The majority remain focused on one thing: “making money.” These projects often function like “open casinos,” accessible at any time to anyone, where participation is open to all. These new casinos are “openly evolving,” with project teams constantly upgrading technology to create an array of new schemes that attract waves of speculators to place their bets. The influx of resources further drives technological and commercial innovation; thus, the “casino ecosystem” evolves in these cycles.

On the dark side, in areas where regulation has yet to reach, criminals often exploit cryptocurrencies for money laundering, drug and weapon trafficking on the dark web, and other illegal activities in an attempt to evade sanctions. Fraud, scams, and financial collapses are also rampant in this space, and decentralized finance platforms and wallets frequently become targets for hackers. These are undeniable realities. The primary reason is that innovation in crypto is relatively free and open, with its ecosystem evolving much faster than regulatory frameworks can keep up. The “blank areas” where regulation hasn’t yet touched naturally become hotbeds for evil. Moreover, the iteration of technology takes time, and it is challenging to create a “perfect” underlying architecture in the early stages of any new tech. Bugs are often identified and patched through trial and error, but this also provides potential attack opportunities for hackers, inevitably making crypto a hotbed for evil.

The mix of three states makes it difficult for the vast majority to get a clear picture of what crypto’s really about. Some are blinded by the endless future and worship it without question; others are scared off by evil and avoid it altogether; and then there are those who see it merely as an open casino to win big, losing sight of its deeper significance.

Chris Dixon, in his book, Read Write Own: Building the Next Era of the Internet, posits that blockchain networks have the potential to blend the societal benefits of protocol networks with the competitive advantages of corporate networks, ultimately reshaping the Internet into a more open, democratic, and innovative space. I believe this vision represents the “endless future.” The book is succinct and accessible, making it a must-read for anyone looking to grasp the true potential of blockchain and Web3.

However, possibly due to space constraints, Dixon only briefly acknowledges the skeptics in his book without delving deeper into the complexities they raise. To truly understand crypto, I believe it’s essential to address several core questions:

First, what is the essence of crypto?

In “Casino on Mars,” Matt Huang suggests that crypto is like a new planet worth building because it offers a blank slate where we have the opportunity to establish a new system of property rights, along with a revamped financial system and internet platform. This is a broad, macro-level analysis. But from a more micro, first-principles perspective, what exactly is the essence of crypto? How does it fundamentally differ from existing global systems? What are the enduring foundations and driving forces that ensure its continued growth?

Second, why, after 16 years, is our understanding of crypto still so divergent?

The birth of new technology often brings significant skepticism and uncertainty—not just because it reshapes our way of life, but because it challenges our deeply held beliefs and values. For instance, the divergent views surrounding the iPhone and Tesla quickly unified. Yet today, despite the significant strides made by the crypto industry led by Bitcoin, there remains a wide array of conflicting opinions. Why is public perception of crypto still mired in confusion and conflict? Why do so many people fail to recognize the bright future of crypto?

Third, why is there such pervasive and persistent evil within crypto?

Why, after more than a decade of development, does crypto still suffer from frequent chaos and disorder? Many attribute this to the notion that “any emerging financial market will encounter various problems.” However, there is a profound contradiction at play, which I term the “Crypto Paradox”: The original intent of crypto was to use blockchain technology and decentralization to establish a new system that “Can’t be evil,” rather “Don’t be evil.” Yet, we find ourselves in an era where evil is rampant, creating a perplexing dilemma. It raises the question: Is there something inherently unique about crypto evil that fosters such behavior?

Fourth, how can we achieve the original vision of crypto, ensuring a safe and ethical environment for its development?

Crypto is still in its early stages of growth, with many order and norms still being established. Newcomers who rush in without caution may find themselves losing both time and money. When existing infrastructure fails to support the decentralized ideals of crypto, can we collaborate with traditional regulatory bodies and communities to create mechanisms that proactively address and prevent misconduct? Can we build an “immune system” for crypto that cleanses its development environment comprehensively? At the same time, can we also provide ordinary participants with a broader perspective, enabling them to better understand the full picture of crypto’s evolution?

The “immune system” of the crypto world

These are not questions that can be answered through a few articles.

Since my first encounter with Bitcoin and Ethereum in 2016, I’ve lived through two major boom and bust cycles in crypto, witnessing firsthand the dramatic ups and downs of hundreds of crypto projects. Some have navigated these cycles, still standing strong; others made waves in the bull market only to collapse in the bear era; some even disguised themselves under Web3 and decentralization, engaging in Ponzi schemes and fraud.

When we strip away the halo bestowed by “crypto” and “decentralization,” turn off the beauty mode, and remove the filters, what do these projects truly look like? Are they crypto startups, crypto businesses, or simply crypto money-grabs? My past experiences have deeply impressed upon me the dangerous yet alluring complexity and chaos of crypto, as well as the critical importance and urgency of understanding and addressing these challenges together in this current phase.

For some time now, I have wanted to write a book that gathers the rational and profound insights buried under a deluge of information. I aim to explore the underlying principles behind these common challenges, attempting to weave together existing wisdom into a more scientific and systematic framework. I plan to title this book The Protocol Revolution and DigiLaw Engineering. The goal is not only to understand these issues from a first-principles perspective but also to outline a comprehensive practical methodology, hoping to reduce the blind, haphazard exploration by participants and minimize unnecessary trial-and-error costs.

Writing this book does not imply that I have the definitive and profound answers; rather, in the chaotic early stages of crypto, there is a genuine need to organize and summarize effectively. Therefore, the 1.0 version of this book will be completed by a centralized small team led by myself. But this is only the beginning—I hope it can evolve into an open community of discourse, where everyone can engage in open discussion, exchange ideas, and collaboratively create the 2.0 version of this book.

It’s worth noting that when describing this field, I prefer the term “crypto.” As the industry develops, the possibilities built on blockchain over the next few decades will far exceed our current imagination. Buzzwords like “Web3” and “Metaverse” may be replaced by new emerging concepts. Today, the “crypto world” typically refers to this entirely new digital ecosystem built on public blockchain following the advent of Bitcoin and blockchain. It also encompasses the infinite possibilities that could arise from the integration of emerging cryptographic technologies, such as Zero-Knowledge Proofs (ZKPs) and homomorphic encryption within blockchain technology. At least for now, I believe that “crypto world” remains a relatively appropriate term.

This book will focus more on exploring and distilling the universal principles that have been validated by the market, and that can help participants navigate through bull and bear cycles to address long-term challenges. As for the current trending topics, I do not intend to discuss them in depth, as they may not stand the test of time.

This article serves as the preface to the book, Protocol Revolution and DigiLaw Engineering, providing a brief overview of my thoughts on the four questions above and a preview of the book’s vision and content.

Question 1: The Essence of Crypto

Personally, I believe in Bitcoin and am optimistic about the future of smart contracts and Web3, as exemplified by Ethereum. But as a researcher, I’ve spent the past few years questioning myself:

Strip away all the buzzwords and hype—by 2050, when humanity looks back at the entire crypto world built on blockchain, what will its most essence be?

I think I’ve started to form an answer: The essence of the entire crypto world lies in “tokenized decentralized protocols.”

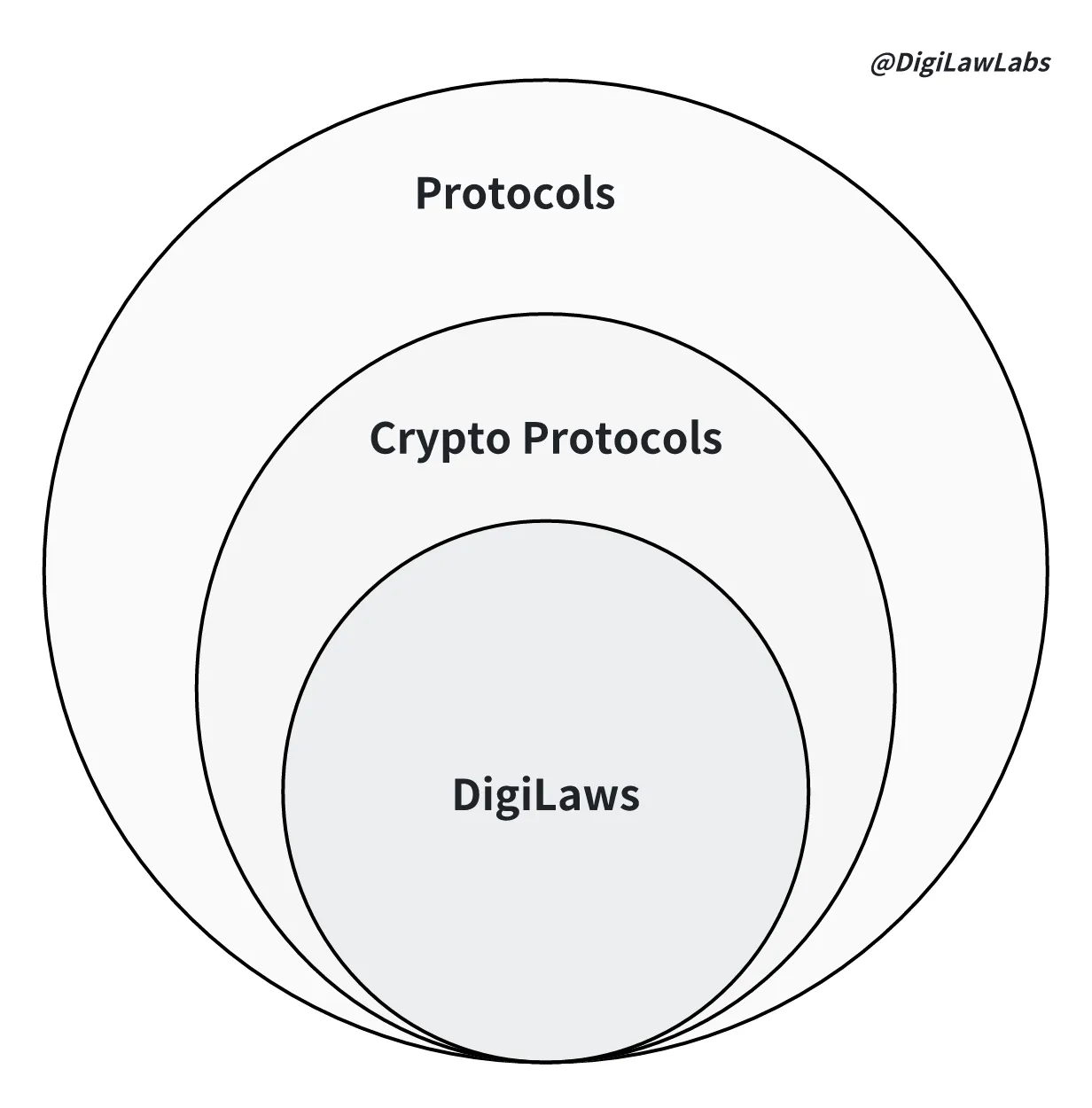

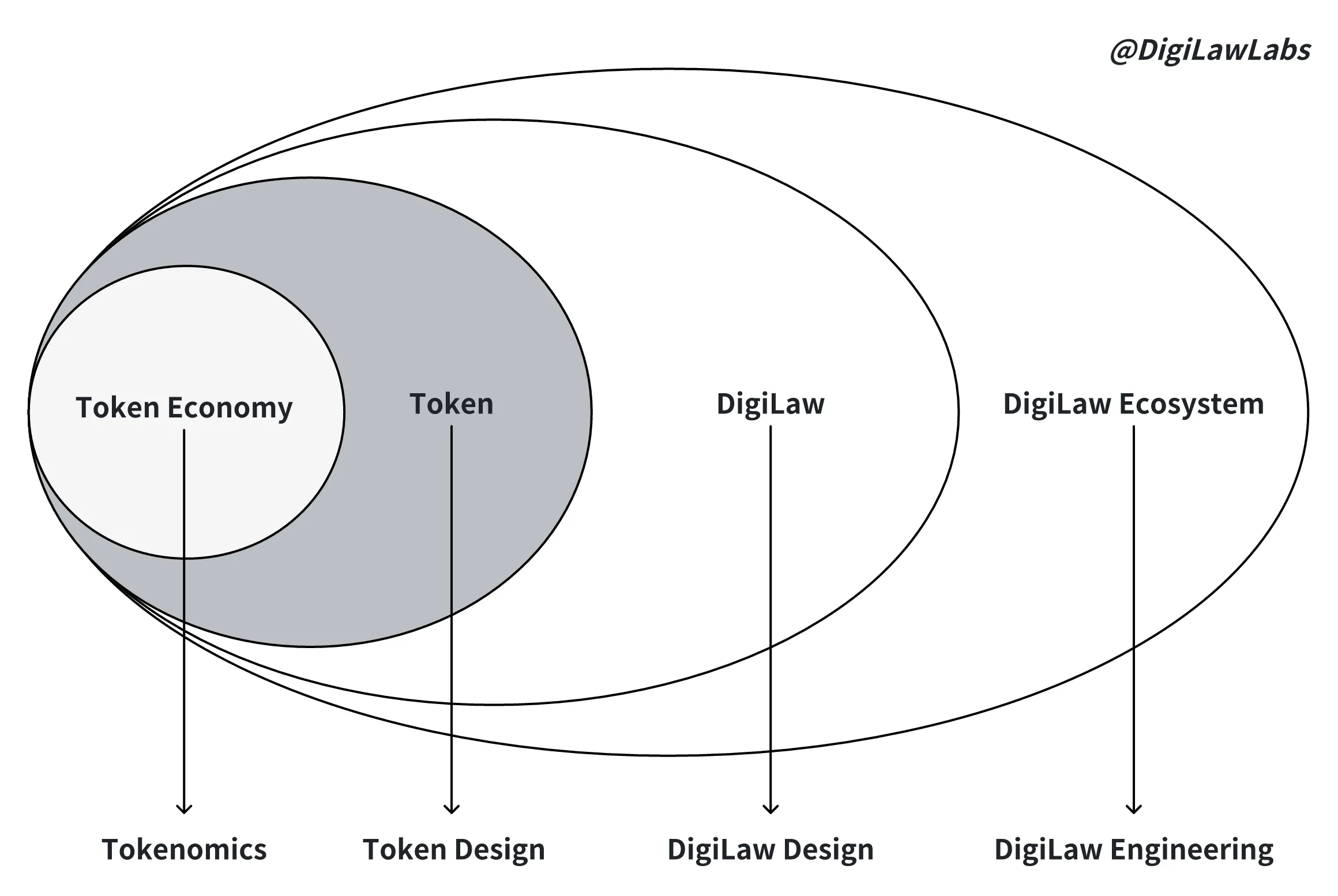

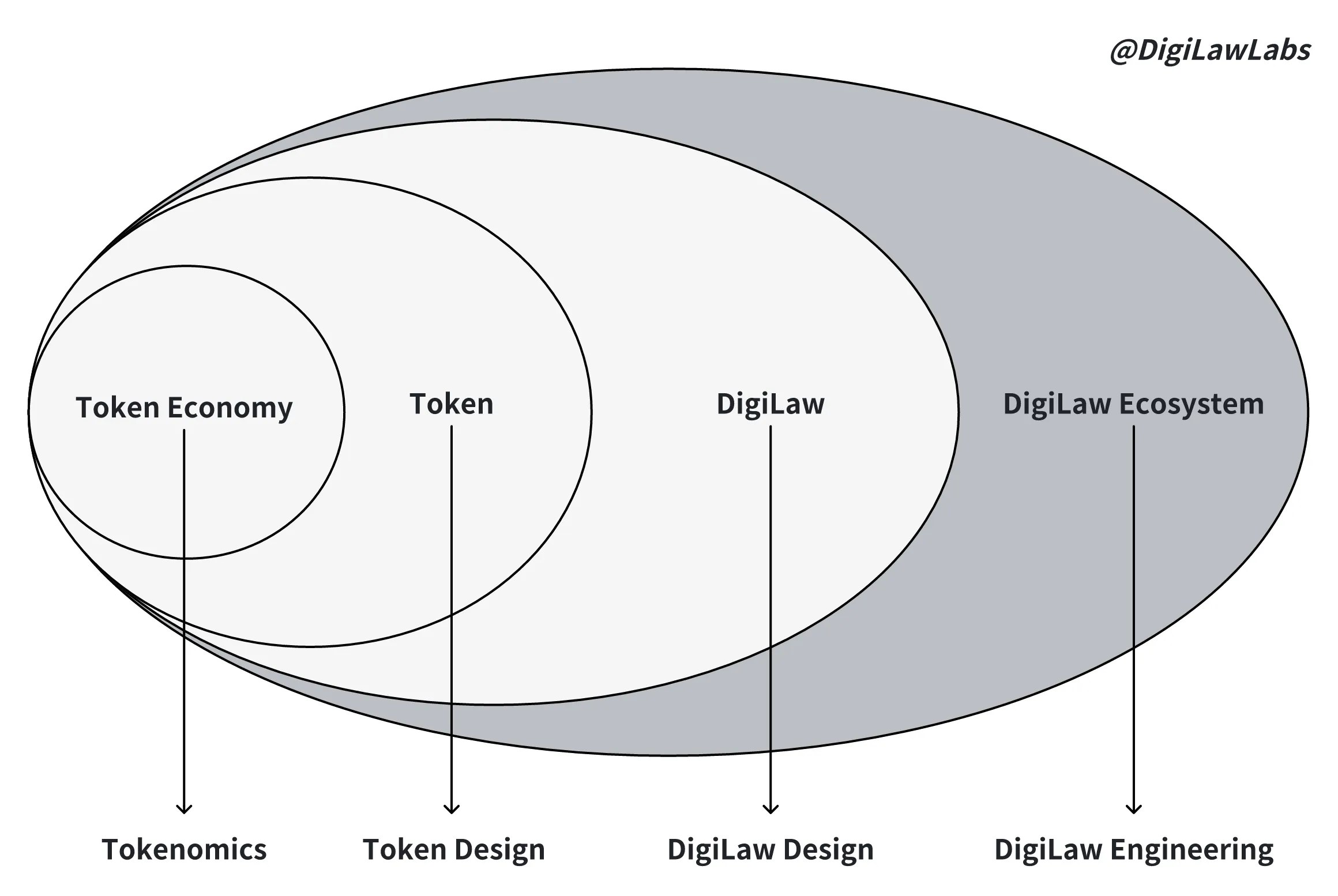

To better convey this insight, I refer to these “tokenized decentralized protocols” as “DigiLaws.” The term “protocol” is too broad—encompassing everything from TCP/IP to the Paris Climate Agreement, traffic rules, real estate contracts, and even verbal agreements. These are entirely different from what we are discussing here. Today’s “crypto protocols” mainly include “blockchain protocols” and “smart contract protocols.” I use “DigiLaws” to describe those protocols that aim to advance decentralization and tokenization transparently (as illustrated in the diagram below).

The relationship between “Protocols,” “Crypto Protocols,” and “DigiLaws”

The term “DigiLaws” draws its inspiration from the “digital world” and the “laws of nature.” It directly points to the essence of these crypto protocols, which, like natural laws, are transparent and tamper-proof/immutable. (Note for non-crypto users: “tamper-proof/immutable” here doesn’t mean the protocol never changes, but that any changes must occur under collective consensus, not dictated by a few individuals.)

“DigiLaws” allows non-crypto users to grasp its essence at a glance, while also serving as a constant reminder to crypto participants not to get lost in the flashy narratives. Instead, they should hold projects to the high standard of “DigiLaws,” ensuring they uphold the principles of transparency and immutability. Even if a project cannot achieve full decentralization and tokenization from the start, it should at least make the entire process transparent, minimizing the potential for exploiting information asymmetry. When “DigiLaws” become a societal consensus, we can collectively see through the disguises of centralized projects and return to the original ethos of the crypto world—“Can’t be evil.”

Decentralization and tokenization are inseparable in “DigiLaws”. As Vitalik stated in his 2024 Token2049 speech: “Blockchains create persistent structures that can be extremely robust.” Decentralization provides the rigid algorithmic consensus that underpins this robustness. It enhances the immutability of protocols, aligning them with laws of nature, and creates a “trustless” environment, minimizing the potential for evil within the protocol. Additionally, tokenization provides the lasting social consensus that further strengthens the system’s robustness. Through incentives, it attracts a large number of participants to collectively safeguard the protocol, forging a social consensus that extends beyond algorithms and persists over time. This broad, unbreakable collective will truly realize the immutability of the protocol. Moreover, the incentives provided by tokens help drive value creation within the protocol and give the protocol a life-like agency, allowing it to grow into a “black hole of attention”. (Think of the “black hole of attention” as a powerful force created when countless people focus on the same thing. This collective attention can shape the world, guiding how things evolve and even collapsing future possibilities.)

In the future digital society, DigiLaws will emerge as a new primitive for both humans and AI. This primitive, designed by humans yet tamper-proof/immutable, will act as the “digital natural laws.” The digital world will no longer be entirely built by humans but will mutate to include a “digital nature” portion that can self-evolve in collaboration with AI. In this digital nature, trust no longer require costly efforts to establish; it will be directly encoded within DigiLaws. Network participants will reach consensus based on tamper-proof/immutable rules supported by cryptography and mathematical principles, rather than relying on central authorities or third parties. This inherently creates a “trustless” environment where trust is embedded in the code itself.

In such a trustworthy, equal, and open environment, value can flow freely, and innovation will no longer be stifled by the limitations and censorship that centralization brings. Coupled with the incentives provided by tokenization, an inherently global, human-wide, bottom-up explosion of innovation will naturally emerge.

For example, in the real world, implementing an idea requires obtaining various permissions, building a team, and investing significant time, energy, and capital to push the project forward. In crypto, the barriers and costs of innovation are significantly lowered. If you have an idea, you can start working on it immediately without needing any permission. With an abundance of nearly free “digital natural resources” available for innovation, you could soon be assembling a professional AI team at minimal cost, working around the clock to build and promote your original “DigiLaw Lego.” Everyone can take the existing “Legos” as “building blocks” and rapidly construct more advanced and complex new “DigiLaw Legos.” This explosion of grassroots innovation will drive the emergence of a diverse digital ecosystem at an unimaginable speed, evolving independently and without restrictions.

The fruits of this “protocol revolution” will permeate every aspect of the economy and society at an exponential rate, establishing entirely new paradigms. The development of this digital nature, nurtured by crypto technology, will quickly surpass that of digital artifacts.

In this never-ending “protocol revolution,” crypto will eventually expand into an “endless future,” a time when our thoughts and ways of life may be profoundly transformed.

Most repetitive, routine tasks will be effortlessly handled by AI, freeing humanity from the pressures of survival. In this trustless digital natural environment, the full innovative potential of humanity will be unleashed. Driven by the collaboration between AI and humans, the collective focus of the world will increasingly shift toward the pursuit of creation and experience, marking the dawn of a new and vibrant era—I call it the “CreateX Era.”

The CreateX Era

However, we are still in the early stages of exponential growth in the crypto world, and for most people, this answer is far from obvious.

Question 2: The Divergent Perception

Crypto, as a transformative force at the intersection of technology and modern society, has shown undeniable momentum in its development. Yet, despite this progress, crypto has long lacked a killer application that addresses real-world problems on a large scale—Bitcoin being a potential exception on the horizon.

The public’s perception of crypto remains deeply divided. Whether they are idealistic dreamers, innovators seeking breakthroughs, or opportunistic adventurers, investors hunting for the next big thing—or even bad actors with no good intentions—it’s easy for these individuals to lose their way amidst the clamor of “skepticism and fear” on one side and “blind faith and worship” on the other.

Skepticism and Fear: Since Bitcoin’s inception, crypto has grown from the fringe into a massive ecosystem worth around 2 trillion dollars. However, skeptics have never shed their apprehension and fear, viewing crypto as a “dark planet” fraught with danger, one they are unwilling to venture into.

This distrust stems from a natural skepticism towards new technology and a lack of understanding of the principles behind crypto, as well as the profound social transformations and advancements it promises. This fear is further exacerbated by the widespread fraud, money laundering, hacking, and other issues prevalent in the crypto space. The combination of these factors amplifies participants’ skepticism and fear to an extreme level. The intense market volatility, the very real speculative behavior, and the frequent negative news stories, often sensationalized by traditional media, deepen their misconceptions about Bitcoin, blockchain, DeFi, and Web3. To them, these innovations appear to be nothing more than vacuous concepts, a playground for scammers, a speculative casino, or worse—an organized scam, or at its most nefarious, a hotbed for illegal activities.

Skeptics question the true value of blockchain technology. They see the skyrocketing prices of crypto assets like Bitcoin and Ethereum as bubbles destined to burst. They view crypto as a ticking time bomb full of chaos and uncertainty, posing a serious threat to the order and stability of their society.

Blind Faith and Worship: On the opposite end of the spectrum exists a faction of “believers” who hold a starkly different view. To them, crypto is a shining utopia. They see Bitcoin as the currency of freedom, and view cryptocurrencies and blockchain technology as the ultimate solutions to modern financial systems and the future of technology. These individuals deify figures like Satoshi Nakamoto and Vitalik Buterin and consider themselves pioneers of a new era. Their blind faith in blockchain technology is often fueled by the media’s extensive coverage and hype, especially stories of people achieving rapid wealth through crypto. This only intensifies their excessive reverence.

They ignore the practical issues surrounding the application of crypto technology, focusing solely on self-congratulatory narratives—every market upswing is seen as vindication of their beliefs, and any doubts are dismissed as betrayal or envy. While this sentiment is understandable—it reflects a yearning for a better future—such excessive optimism and faith can lead to irrational decision-making, ultimately resulting in both emotional and financial ruin.

Caught between two voices, participants tend to follow trends and speculate blindly. In this world torn between skepticism and blind faith, participants often struggle to calmly and critically assess the true value of crypto technology.

The technological complexity of crypto makes it challenging for the general public to understand how it works, leading them to focus more on price than on the underlying technology. Additionally, the high volatility and potential risks of the crypto market easily trigger panic among participants, making them susceptible to the influence of others’ actions and words. Consequently, their decisions are rarely based on thorough independent research and rational judgment.

In this situation, people often overlook a project’s technical groundwork and potential value; instead, they just go after trends. They get all hyped up and invest a lot when the market is doing well, hoping to get rich overnight. But when the market goes down, they get all scared and unsure, leading to panic selling and big losses.

Meanwhile, some crypto manipulators take advantage of the public’s herd mentality and desire for quick riches. What do they do? They aggressively pump worthless projects and encourage speculative and risky behavior, causing chaos in the market. This leads to heavy losses for investors during unpredictable price swings and hinders the healthy growth of the crypto industry.

Question 3: The Unique of Evil in Crypto

Extreme opinions often attract followers more easily because they simplify complexities and reinforce emotional identification. The noise of the crowd can quickly drown out the few rational voices. To gradually unravel the puzzle of the “Crypto Paradox,” we first need to delve deeper and explore the interlinked causes behind this dilemma.

Information barriers and fog, Rampant fraud and speculative behaviors, Centralized token economy; Crypto is still in its infancy.

Information barriers and fog create a gap in perception and blind conformity in behavior.

For those who aren’t really into crypto, they are unaware of the groundbreaking changes within crypto and only occasionally catch snippets of alarming news. They refuse to accept any objective reports, instead constructing a solid “information barrier” out of preconceived notions.

For participants, it is equally difficult to access real and valuable information. The internet grants everyone unprecedented access to information, but it also brings problems of fragmentation, redundancy, and noise. Especially in emerging areas such as crypto, different opinions and theories sprout up quickly. Truly forward-looking insights are rare, and the market is flooded with a mix of true and false information, further intensifying the chaos.

Crypto veterans know that only a tiny fraction of projects and information is really valuable. Most participants, however, are mired in the “information fog,” unable to see the full picture of crypto, leaving them to follow the crowd blindly.

Rampant fraud and speculative behaviors have worsened these barriers and the information fog.

In the crypto market, some bad actors seek to make quick, illicit gains. They exploit participants’ inherent greed and take advantage of information asymmetry to set up seemingly flawless frauds and Ponzi schemes within the “open casino.” These schemes, masquerading as paths to “financial freedom,” dominate the speculative frenzy. They flood the market with distorted, “carefully packaged” information, deepening the fog to make it easier to commit their next evil. The crypto ecosystem appears caught in a vicious cycle that’s difficult to break.

Here, I’d like to clarify: while fraud and scams are pure evil and should not exist, I do not wish to completely condemn speculation. As Matt Huang pointed out, “today’s speculative frenzy in crypto is attracting the settlers and catalyzing the infrastructure necessary to turn a barren planet into a thriving crypto civilization.” “Speculation within crypto helps drive attention and awareness, investment dollars, talent inflows, infrastructure building, academic research, incumbent adoption, and more.” “New tech breakthroughs are consistently entwined with speculation and asset bubbles on the way to mainstream adoption;” crypto is no exception.

Yet, once participants are driven by greed or fail to see the true nature of a project, they usually speculate on shit projects and Ponzi schemes. While there’s a chance of making gains, this behavior largely disrupts market order, forces the industry backward, and pushes crypto further toward becoming a hotbed for for evil.

The misuse of tokens in centralized projects causes the spread of scams and speculative behavior.

Tokens are a double-edged sword; they can truly drive value creation only within decentralized projects. However, many project teams treat crypto as a “decentralization theater.” They wear the mask of decentralization while secretly operating in a highly centralized manner. The moment tokens are issued, the project and its protocol become entangled with public interests, opening the door to exploitation through information asymmetry. These tokens should be subject to regulation, much like traditional securities.

Instead, these projects claim to be “decentralized,” insisting that the community, not the government, should handle regulation. The problem is that the community needs better technology and methods to regulate these projects effectively. As a result, there is a significant “regulatory vacuum.” It allows certain centralized project teams to exploit tokens to amplify the space for evil from the beginning and use the decentralization narrative to draw in uninformed participants or speculators. This has turned the crypto world into a stage for scams and speculative schemes.

The unregulated issuance of tokens in centralized projects is the root cause of the unique propensity for crypto evil. This root cause exists due to at least two major factors: “technology” and “mechanisms.”

From a technology standpoint, crypto’s tech stacks have yet to overcome the “blockchain trilemma,” struggling to create crypto or blockchain systems that are simultaneously secure, decentralized, and scalable. From a mechanism perspective, the imperfections in current mechanisms create opportunities for malicious behavior. At the same time, the design of such ecosystems is highly complex, and our current research on mechanisms and our talent pools are not yet sufficient to support the construction of these skyscrapers.

Yet, many projects claim they are building “automated decentralized skyscrapers.” However, out of ten of these projects, eight turn out to be centralized efforts that put up a nice front to build just two floors before rug pulls; one collapses due to unstable design or attacks; and another is abandoned because its automated systems fail to function. Only foundational, established smart contract protocols like MakerDAO and AAVE, with their decentralized value creation and simple yet resilient protocol mechanisms, have managed to remain standing and survive crypto cycles.

I am not advocating decentralization as the ultimate solution—it is a means, not an end. However, without decentralization, combined with inadequate regulation, tokens can easily amplify the evils arising from centralization. This is undoubtedly one of the most significant challenges crypto faces today.

Question 4: Achieving the Original Vision

To dismantle the root causes of evil , break the paradox, and realize the original vision, crypto requires a dual-engine approach driven by both “technology” and “mechanisms.”

As Vitalik put it, “We are no longer early to crypto.” The rapid advancements of Ethereum and Layer 2 solutions, especially in reducing fees, increasing transaction speeds, and enhancing security, signal that crypto is stepping into a more mature phase. Indeed, over the decade since Bitcoin’s inception, technology builders, mainly focused on coding, have made tremendous contributions to the sustained growth of crypto. Technology is undoubtedly the core engine driving the crypto world toward an “endless future.”

However, “We are early to crypto being usable.” Why hasn’t crypto achieved mass adoption yet? Beyond the need for improvements in user-friendliness and accessibility, a crucial reason is that our research and application of “mechanism design and evolution for the DigiLaw ecosystem” have significantly lagged behind the development of crypto technology. Whether the vast new frontier that technology has opened up will bloom with “flowers” or bear “poisonous fruits” largely depends on whether we have sophisticated enough mechanisms to guide and regulate it effectively. The current chaos in the crypto world to some extent reflects that our mechanism design is still far from refined, leaving ample room for evils. This is undeniably a major barrier to the broader adoption of crypto. If we want to reach the next billion users, we urgently need to raise the overall ethical and security standards of the DigiLaw ecosystem. Yet, as we all know, this is no easy task.

The Concept Map

The DigiLaw ecosystem represents an entirely new “species” in human history. A DigiLaw can be understood as a set of rules designed to achieve specific goals, where participants collaborate or compete based on these rules, thereby creating an open and self-evolving complex system—what this book refers to as the “DigiLaw ecosystem.”

Unlike “mechanistic” CES(complex engineered systems), such as chips, airplanes, or bridges, DigiLaw ecosystems are more like “adaptive” CAS(complex adaptive systems), such as natural ecosystems, global climate, or immune systems. These systems involve not only interactions at the micro level but also emergent phenomena that span from micro to macro level.

It is important to note that “mechanistic” and “adaptive” are not entirely opposing states; rather, they exist at opposite ends of the same spectrum. Overall, crypto protocol ecosystems tend to lean more toward the “adaptive” state. However, our current level of mechanism research is not yet sufficient to support the construction and sustainable operation of a “completely adaptive” system.

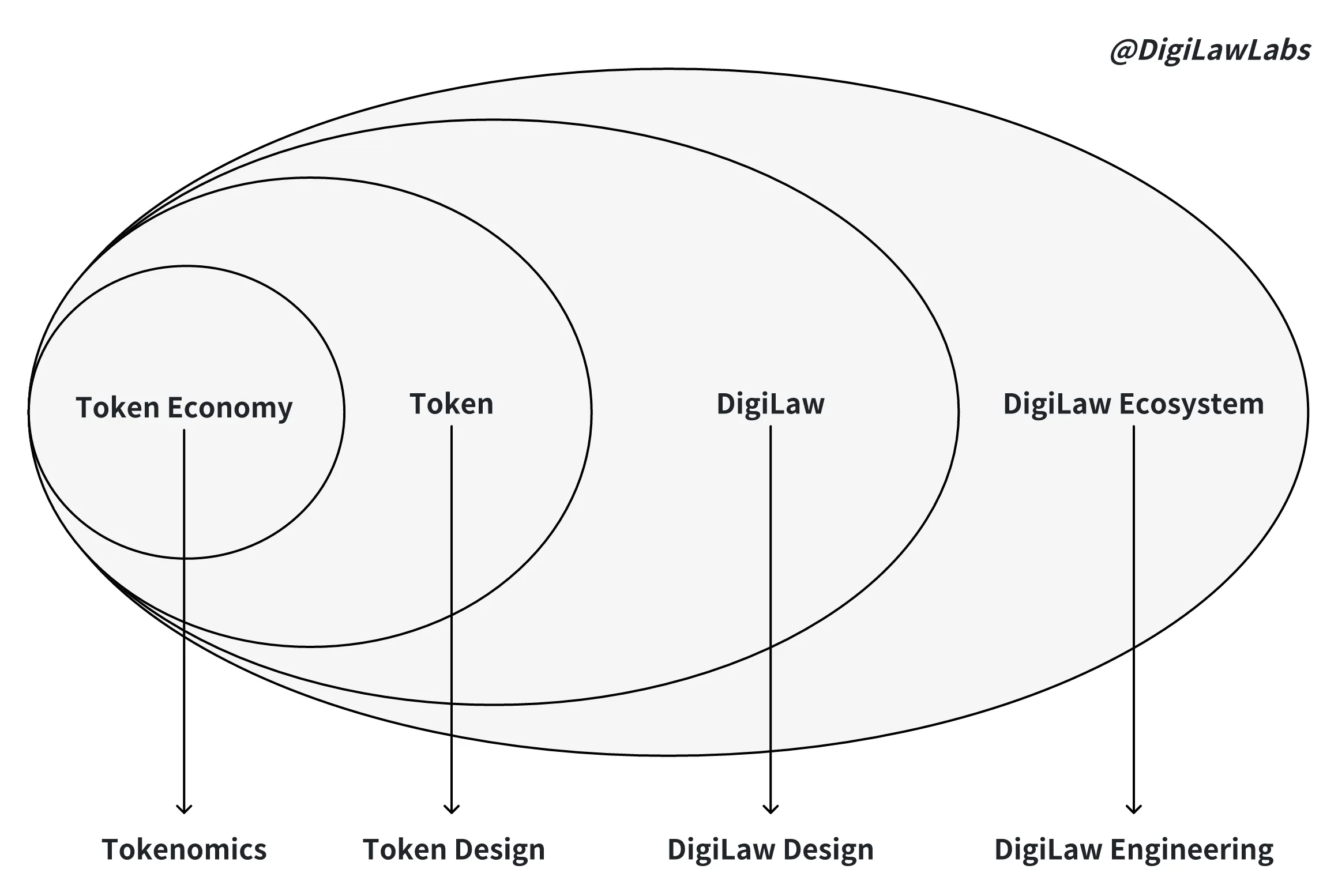

The design and evolution of these “adaptive systems” present a brand-new, world-class challenge. Even the design of tokenomics involves tackling Nobel Prize-level problems, such as reverse game theory and incentive compatibility. Moreover, these issues must be addressed at higher levels, including token design, DigiLaw design, and the overall DigiLaw ecosystem design(as illustrated in the diagram).

From certain perspectives, the complexity of this task rivals that of designing advanced chips, rockets, airplanes, cars, or skyscrapers. Therefore, we can’t solely rely on the “Model-Based System Engineering (MBSE)” methods developed for “mechanistic” systems. We need to upgrade to an “Agent-Based System Engineering (ABSE)” approach, tailored for adaptive systems with emergent behaviors, to understand, design, and simulate every level of the DigiLaw ecosystem’s lifecycle.

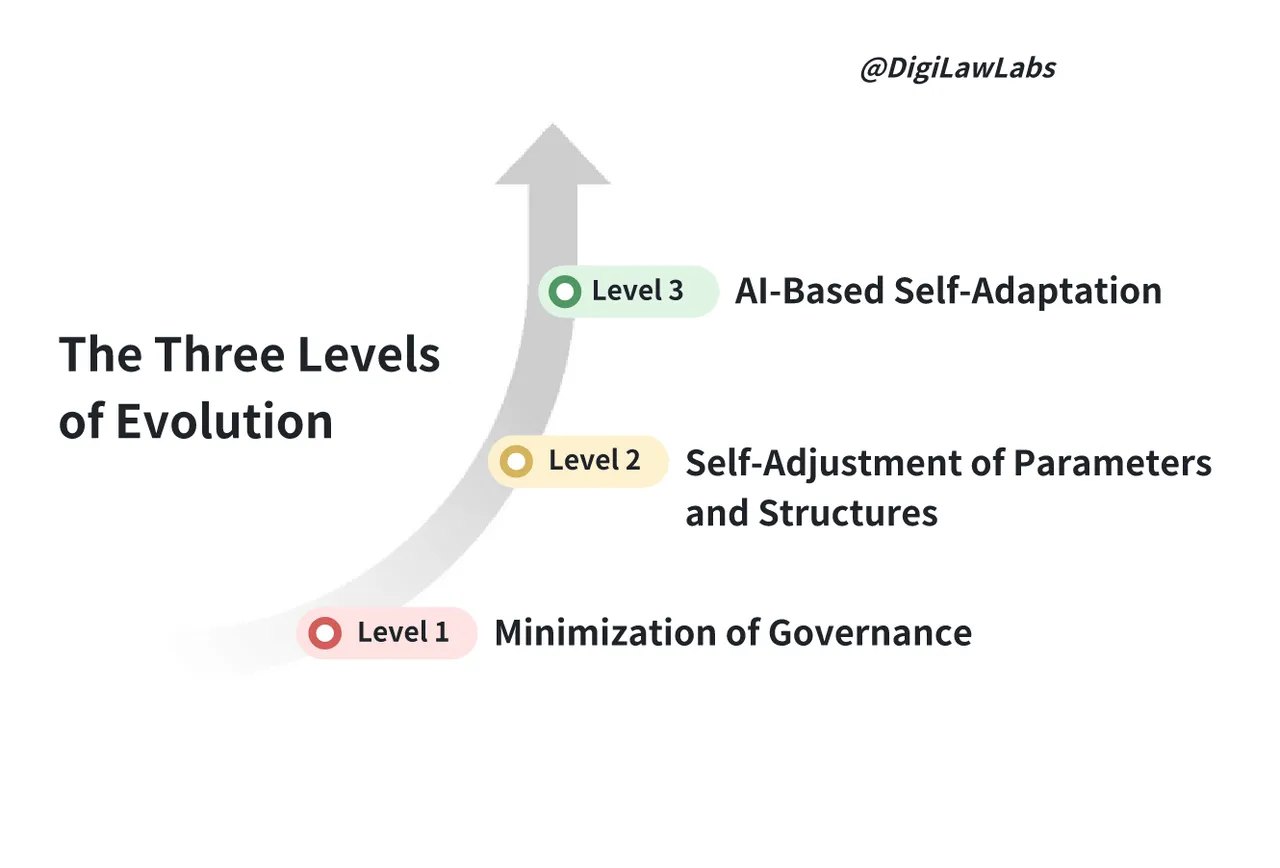

In addition to the design challenges, the evolution of such “adaptive” systems faces more significant challenges. How can we minimize human governance? Is it possible to build a comprehensive self-adjusting system that can dynamically adjust its parameters and mechanisms based on changes in the external environment and internal operations? And in the future, could we leverage powerful AI to achieve true self-adaptation in these “adaptive” systems?

Three Levels of Evolution

If you closely examine blue-chip protocols that have weathered both bull and bear markets, like Ethereum, AAVE, and Compound, you’ll notice a common thread: they have invested a significant amount of time and effort into mechanism design and evolution.

From another perspective, determining whether a project is trustworthy goes beyond just verifying if it has conducted thorough code security audits. More importantly, you should look at whether DigiLaw engineers are continuously engaged in the project’s ecosystem design, parameter adaption, structure innovation. If they are, this indicates that the project team is making a genuine effort to respect human nature, the principles of ecosystem operation, and the financial security of every participant from both ethical and sustainable perspectives.

(Note: In the TokenEngineering field, these professionals are often referred to as “token engineers.” The term is distinctive, novel, and clearly defined. I’m torn between “token engineers” and “DigiLaw engineers.” However, consider protocols like AAVE and Compound, which function as highly automated ecosystems. The parameter optimization of their economic mechanisms—such as adjusting key metrics like collateral ratios and liquidation thresholds in core lending business—significantly impacts the security and efficiency of the entire ecosystem. Yet, these critical issues are unrelated to their native tokens. Instead, they serve as the key leverage points that drive the robust and efficient growth of AAVE and Compound protocol today. Compared to “Tokens,” “DigiLaws” represent a more comprehensive concept. I’m concerned that the term “Token Engineer” might mislead people into thinking these professionals focus solely on “tokens,” while “DigiLaw Engineer” more accurately reflects their role in designing and maintaining the digital world’s laws. Therefore, I’ve chosen “DigiLaw Engineer” as the 2.0 version of the “Token Engineer.”)

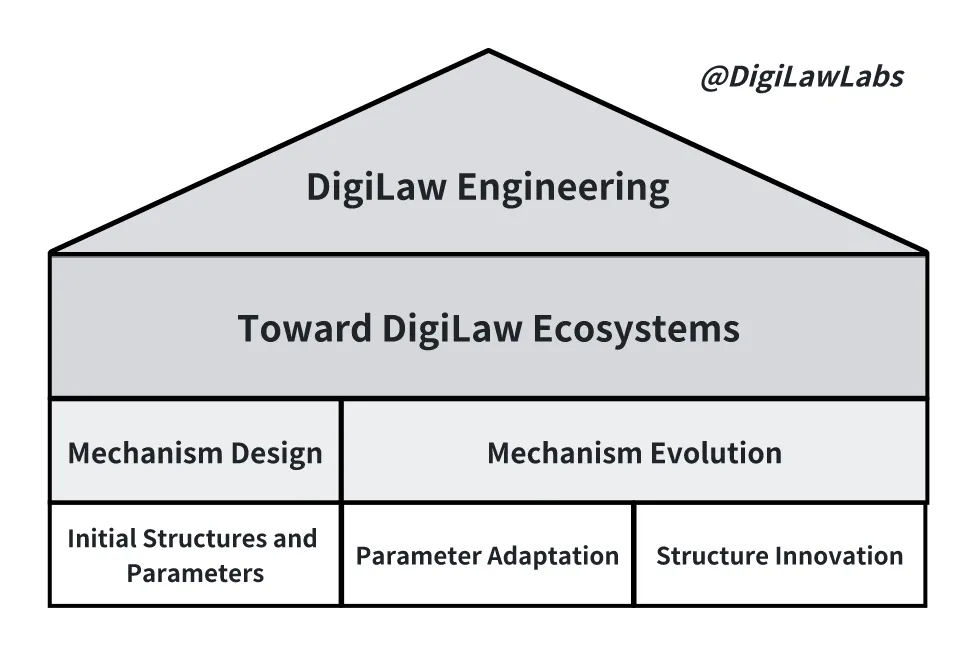

DigiLaw Engineering

Note: “Evolution” refers to the process of making dynamic adjustments to the mechanisms of a crypto protocol ecosystem in response to environmental changes, including parameter adaptation and structure innovation.

However, the current crypto world still does not place enough emphasis on DigiLaw engineers. Despite ongoing efforts by organizations like TEC to advance “Token Engineering” and the significant achievements made, the principles and methodologies of “Token Engineering” have yet to be widely adopted. Many project teams, investors, and others remain at the “Tokenomics” level, often unaware of “Token Engineering.” This situation reflects that we are still VERY early in the research of mechanism design and evolution within the DigiLaw ecosystem. This is evident not only in the lack of theory and practice but also in the shortage of specialized talent. For the crypto world to overcome the bottlenecks in security and efficiency, the potential and value of DigiLaw engineers need to be further explored and realized.

Technology pioneers uncharted territories, while mechanisms guard vast lands. Without the collaborative drive of both, it is difficult to build a balanced, robust, and antifragile DigiLaw ecosystem. The ultimate ideal is a state where, without any human intervention, “technology” and “mechanisms” are robust enough to support these DigiLaw ecosystems’ inherent self-defense and automatic efficiency optimizations.

But we all know that the iteration of technology and the cultivation of DigiLaw engineers do not happen overnight. When these dual engines cannot fully support the original vision of crypto, we still need ‘external artificial defense’ to safeguard the ethics and security of crypto.

The technology tree won’t grow overnight; it takes time.

Crypto urgently needs to establish a new defense system to counter risks. Crypto will likely remain in a hybrid state of centralization and decentralization for some time.

This “hybrid” state has two layers of meaning: first, the decentralization of each DigiLaw is inherently a gradual process; second, the degree of decentralization across the entire end-to-end lifecycle of each DigiLaw varies. For instance, while some DeFi protocols may be highly decentralized, they still rely on centralized infrastructure services for their implementation, and the Apps built on these protocols might also be centralized.

In such a hybrid system, the defense should also be composable. The ultimate ideal is for the community to complete the self-governance of the decentralized parts from the bottom up, while traditional institutions complete the regulation of the centralized parts from the top down.

Currently, governments and other traditional institutions are rapidly advancing their regulatory efforts, which falls under external artificial defense. While this can certainly limit the space for evil, it may also limit the development of decentralization. On the other hand, building a community-driven, self-governance system for DigiLaws can suppress the emergence of evil and systemic risks from within and from the bottom up, supported by technologies and tools. This internal artificial defense mechanism offers a more flexible solution to crypto’s challenges with evil while aligning with the path of achieving the original vision of crypto through decentralization.

Community and traditional institutions regulate the decentralized and centralized aspects from the bottom up and the top down, respectively.

Therefore, to realize the original vision of crypto and establish a secure and ethical digital natural environment, we need at least the collaboration of technology, mechanisms, and a composable defense system. While these three elements may not be exhaustive, they are undoubtedly crucial to breaking through the current bottlenecks in crypto’s evolution.

A Sneak Peek: Your Go-To Guide for Crypto Startups

I intend for “The Protocol Revolution and DigiLaw Engineering” to be an educational effort in this brave new world. It’s a preliminary attempt to guide more attention towards the mechanism design and evolution of the DigiLaw ecosystem and foster a deeper understanding of this critical field, DigiLaw engineering. Perhaps it will inspire a new generation of DigiLaw engineers along the way.

When it comes to content, I plan to take existing ideas, give them a thorough shake, and sift through the common threads that run through the development of DigiLaw. I will also introduce a new design theory for DigiLaw ecosystems and offer hands-on modeling and simulation practices based on ABSE (Agent-Based System Engineering). Along the way, I’ll explain how “maximizing DigiLaw value” and “minimizing crypto world risks” are achieved through the “Model is trust” concept.

But this isn’t just a book; in approach, I envision this as a “Read-Write-Own” social experiment. In the ever-expanding ocean of crypto information, it’s simply not feasible for one person to sift through this chaos, identify what’s valuable, integrate insights, foster innovation, and adapt dynamically on their own. It takes a community. And that’s where the “Read-Write-Own” approach comes in. More on that in the “Final Thoughts” section at the end of this article.

Here’s the game plan for the book, broken down into three parts.

Part I: Protocol Revolution

First, let’s explore the essence and significance of crypto.

I will begin with the concept of “protocols” and closely examine their history. DigiLaws is more than just technical frameworks; they fill a critical gap in the story of protocols in human history, and it’s important to understand how and why.

I’ll keep it simple, walking you through how blockchain and smart contracts have paved the way for a new kind of value network—one that is open, decentralized, and trustworthy, why this new network has these characteristics, and why DigiLaws, as new “primitives,” can give rise to a self-evolving “digital nature.”

The rise of DigiLaws has sparked a major revolution, which I like to call the Protocol Revolution. It’s more than just a technical shift; it’s actually reshaping the very fabric of our technology, trust, organizations, economy, and society as a whole. Through real-world examples, we’ll see just the intrinsic value and transformative power of “crypto protocols” with decentralization and tokenization.

However, whether this “Protocol Revolution” can succeed remains an open question. There’s a gap between our ideals and the current reality, and understanding what’s holding us back is crucial. I’ll dive into the reasons why this gap exists and explore some potential strategies that might help bridge it.

Secondly, we’ll dive into the “trust economy” within crypto.

From the fresh perspective of the trust economy, I’ll briefly examine the major developments within crypto and outline a simple yet effective framework for evaluating the trust economy of these protocols.

Crypto sets itself apart from the traditional world through three main pillars: security, transparency, and decentralization. However, not all that glitters is not gold—many projects claim to be decentralized but still have a centralized core at their heart, posing significant risks to those who get involved. So, there’s a pressing need for a more comprehensive evaluation framework that can help us determine whether a protocol truly deserves to be “trusted” or to what extent it “Can’t be evil,” thereby standing out as a “DigiLaw.”

I’ll objectively analyze the “trust crisis” currently shaking crypto and identify the key factors and indicators that make up this “trust economy.” By looking through this lens, I’ll briefly review some key sectors like public blockchains, DeFi, NFTs, and some new but important sectors and trace the history and classification of their protocols. With these trust indicators as the guide, I’ll analyze the unique traits of crypto protocols in each sector, step by step building a “trust economy” evaluation framework for crypto protocols.

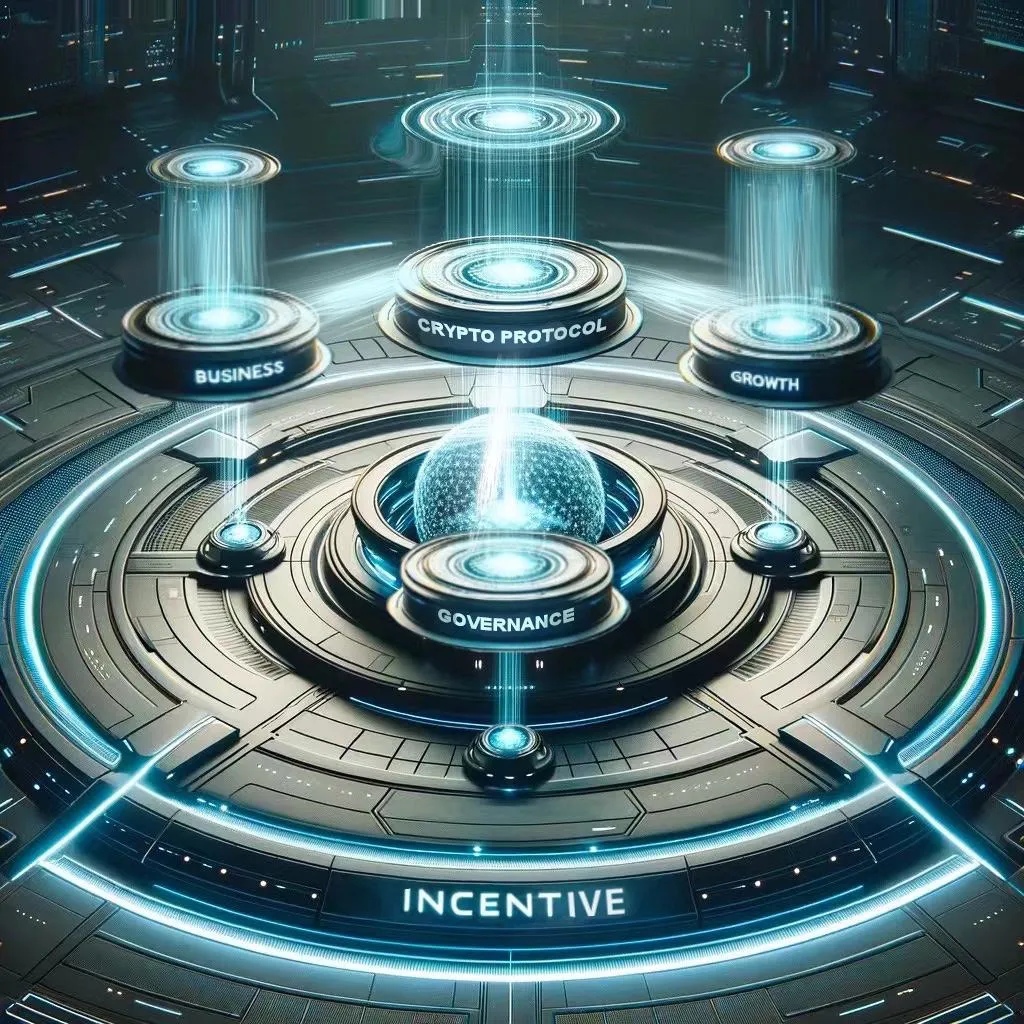

Lastly, let’s explore how DigiLaws creates value and clarify how business, growth, governance, and incentives all work together.

Business is crucial to ensuring that A DigiLaw does not become “empty.” If a project team can’t design their business with value creation at the forefront, they’re likely to lose their protocol’s sustainability over time, or even worse, accelerate its downfall due to the “amplification effect” often seen in today’s tokenomics. To navigate these challenges, I’ll walk through design principles and case studies to help you pinpoint market pain points, define DigiLaws’ core objectives, and build robust and innovative businesses.

Growth is essential for the mass adoption of DigiLaws. I’ll break down the growth logic and core strategies, from community-driven efforts to effective launch tactics. Through real-world examples, I’ll show how growth mechanisms can help a project achieve its cold-start and create powerful network effects.

Governance is also a cornerstone for the long-term survival of any DigiLaw. I’ll explore the essentials of governance, the critical role of communities and DAOs, decision-making processes, voting mechanisms, and how to structure governance incentives. Through case studies, I’ll reveal how strong governance can lead to a self-optimizing DigiLaw.

Business, growth, and governance form the backbone of any successful DigiLaw, while incentives are the lifeblood that runs through them and empowers the ecosystem. I’ll dig into what makes tokens unique in DigiLaw’s incentive structures, covering the basic principles, the various types of incentives and how they’re structured, and how to design them to shape participant behavior effectively. To tie it all together, I’ll present numerous incentive design examples showing the crucial role of incentive mechanisms in real-world DigiLaw applications.

Business, growth, and governance are the core components that fuel the growth of crypto protocols, while incentives are the key drivers that infuse energy into these aspects.

Part II: From Tokenomics to Token Design

From Tokenomics to Token Design

First, it’s crucial to clarify the relationship between “tokens” and “DigiLaws.” I will also provide a basic token economic model to help you better understand their connections and explore the magic of modeling.

In Part I, we discussed the principles of DigiLaws’ value creation. However, more than value creation is needed to sustain a vibrant and lasting ecosystem. The project team must also consider how well tokens are designed.

For DigiLaws, tokens aren’t just digital assets—they’re like the engines that drive participation within a network. With tokens, DigiLaws can effectively incentivize its participants and distribute the value it creates across its community. This keeps the value circulating efficiently within the ecosystem, giving it the ongoing energy it needs to grow and evolve itself.

But designing tokens isn’t a straightforward task. Even within the seemingly narrow field of “tokenomics,” building a balanced, resilient, and sustainable tokenomics mechanism is no simple feat. It requires a deep understanding of complex, interdisciplinary knowledge like game theory and incentive compatibility.

With the provided basic tokenomic model, you can better understand how everything fits together. This model is like a test drive; it allows you to experience the explosive variables, deeply intertwined mechanisms, complex relationships, and dazzling dashboards firsthand. Go, and get your hand dirty. Remember when you drive a car on the road for the first time? You know everything before sitting in the driver’s seat, but you do not know how the whole system works together.

Reading a few articles on supply and demand won’t equip you to master this model, let alone design a relatively complete and robust token mechanism. This model is your playground to truly understand token design. So, let’s use this model to gradually rebuild our understanding of “token design.”

Next, let’s break down the model step by step and dive into the art of token design. I’ll explore a token design methodology that goes beyond tokenomics by combining qualitative and quantitative research, as well as theory and practice.

Due to various constraints, tokenomics often gets bogged down by short-term issues. It can also become overly complex, lack transparency, and sometimes overlook the essence of value creation.

This book aims to provide a comprehensive, systematic, and practice-oriented framework for token design, building on existing community efforts from a model perspective.

I will break down token design into key areas such as goal and requirement assessment, stakeholder and incentive mechanisms, token supply-demand balance, token and value flow, and parameter adaptation and structure innovation. Each of these is presented through scenario-based models.

For example, in the “Token Supply-Demand Balance” scenario, I’ll use the model throughout to facilitate a visual, interactive learning experience. This includes:

- Introducing theoretical knowledge of token supply and demand mechanisms, and dynamic analysis.

- Bringing in quantitative indicators like trading volume, price volatility, and buy-sell pressure to measure supply-demand balance.

- Reconstructing common pitfalls in supply-demand design through the model.

- Analyzing case studies to uncover the underlying reasons behind successful supply-demand designs.

- Summarizing a practical guide based on the model to achieve a robust supply-demand design.

Through this blend of theoretical exploration, model demonstration, and hands-on practice, participants gain a deep understanding of the principles behind constructing tokenomics models. They will also be equipped to iteratively design, refine, and optimize these models, ensuring their mechanisms are both effective and sustainable.

Finally, let’s combine these models to optimize token design on a global scale. Through model experiments, I’ll also explore dynamic parameter adaptation and structure innovation post-launch.

Achieving a stable balance in each individual scenario model is relatively easy, but that doesn’t mean the integreted model is the best solution for the entire system. It’s crucial for the project team to align token design with the overall goals of the DigiLaw ecosystem. This involves balancing short-term gains with long-term sustainability while addressing growth and security.

A system-wide perspective of token design not only helps to map out how tokens and value flow within the network, but also identifies where supply and demand need adjustments and the key mechanisms that capture value and maintain system balance. This high-dimensional insight allows us to develop a more comprehensive understanding of token design, leading to safer and more efficient mechanisms where every part of the system operates optimally.

However, token design isn’t a one-time deal; it’s an ongoing process. Token designs must dynamically adapt to shifting market conditions and evolving community needs.

Through experiments, we can simulate different scenarios to identify the optimal mechanisms and parameters for various market conditions. We might even explore creating a dynamic adjustment mechanism that enables ongoing adaptation and innovation in token mechanisms.

In the end, we’re not just building a dynamic token design; we’re creating a prototype of the new economic system that’s self-adjusting and sustainably evolved.

Part III: DigiLaw Engineering

DigiLaw Engineering

It’s important to note that while the second part of our discussion delved deeply into tokens, the DigiLaw ecosystem presents many issues and challenges that go beyond tokens. Examples include adjusting key parameters in AAVE’s lending business and optimizing concentrated liquidity strategy in Uniswap V3.

As BlockScience and cadCAD teams emphasize, this is a “complex system.” Designing and evolving such an interdisciplinary, highly emergent, and adaptive ecosystem with a practical focus is an unprecedented challenge. It extends beyond token-related issues to include high-dimensional, complex topics like economic and governance mechanisms.

For this reason, I prefer to refer to this field as “DigiLaw engineering,“—a term that not only carries forward the spirit of “Token Engineering” but also expands its scope. DigiLaw Engineering applies to designing and evolving the operating laws of the entire decentralized ecosystem, not just tokens. It represents the 2.0 version of “Token Engineering,” and more importantly, it offers a systematic response to the various complex challenges within the DigiLaw ecosystem.

To start, I introduce “holo computing,” based on holographic principle, and provide a full lifecycle modeling and simulation method for DigiLaw ecosystems based on “ABSE” (Agent-Based System Engineering).

Unlike “mechanistic” systems like airplanes or chips, which can be decoupled into a series of simplified models to address specific problems, “adaptive” systems like DigiLaw ecosystems are deeply interconnected, with numerous nonlinear, adaptive behaviors. These complex systems are “computationally irreducible,” meaning that their future states’ probability distributions cannot be predicted by simplified models alone. Instead, they require a 1:1 replication and solution through a powerful “holistic model” at the global level—what I call “holo computing.”

It’s important to emphasize that the future can never be predicted; “holo computing” can only assist in understanding near-term probability distributions of system states and the system’s behavior in extreme scenarios through real-time simulations and stress tests, enabling preemptive interventions to control risks.

This book will explain these complex concepts in an accessible way and demonstrate how to conduct ABSE-based integrated modeling and simulation of DigiLaw ecosystems through simple examples. Additionally, I will outline the “value map” and the specific framework of this method, and briefly discuss its feasibility and implications.

Next, let’s explore the full lifecycle practices of DigiLaw ecosystems mechanism simulation based on AI-Agent. This journey includes three key stages: the “Design Stage,” the “Implementation Stage,” and the “Evolution Stage.”

In the Design Stage, the focus is on off-chain modeling. Here, we transform design concepts into simulation models, covering conceptual design, contract mechanism, and AI-Agent behavior modeling. This phase allows us to efficiently validate our ideas and mechanism logic while assessing incentive mechanisms. This process helps streamline early-stage design, making it more efficient.

Moving into the Implementation Stage, the spotlight shifts to on-chain modeling, where detailed designs are visually represented through models. This involves understanding the goals and methods of on-chain modeling, coding Agent behaviors into smart contracts, and conducting virtual machine modeling on-chain. Simultaneously, various scenario experiments will be fully deployed, such as risk analysis, stress testing, and even attack testing. All these steps are crucial to ensuring the stability and practicality of the design before the DigiLaw’s actual deployment.

In the Evolution Stage, the focus is on building a real-time synchronized “digital twin.” This simulation will be deployed on the most recent fork of the blockchain from a specified block height, while simultaneously inputting real-time data from the environment and users for on-chain synchronous simulation. This is akin to creating a virtual parallel universe where we can simulate various scenarios, especially extreme ones, to evaluate the impact of design and decisions on the DigiLaw ecosystem. This approach minimizes human intervention at level 1 during the Evolution Stage. It also introduces dynamic response mechanisms for DigiLaws to realize self-adjustment of mechanism parameters and structures at level 2, with real-time data and simulation results as key inputs. Looking further ahead, mature AI could be embedded within the “digital twin system,” acting as the brain of the DigiLaw ecosystem. This would enable level 3, where highly intelligent self-adaptation allows for precise, proactive adjustments to future changes, thereby ensuring the long-term sustainability of the DigiLaw ecosystem.

Finally, I will present real-world cases to showcase how the “Model is trust” philosophy and decentralized ABSE methodology make crypto more secure, ethical, and trustless.

We’ll start by modeling a few fundamental mechanisms, such as token issuance in DigiLaws, liquidation auctions, and balance mechanisms in game economies. By using AI-Agent modeling, we’ll recreate these mechanisms on a simulation platform, offering a clear and intuitive view of how they operate.

Following this, I will share specific case studies, where through simulation analysis and parameter optimization experiments, we can better understand and effectively apply DigiLaw.

Lastly, I will detail how to build the decentralized ABSE based on the community and implement key procedures, such as rapid response and testing optimization mechanisms.

The engineering methods and practices discussed require a simple yet powerful tool for implementation. In this book, I will showcase how to practice full lifecycle management on the HoloBit platform.

Holobit is the first no-code, visual platform for modeling, simulating, and optimizing the design and evolution of crypto protocol ecosystems. Its user-friendly and robust features enable teams and communities to enhance risk resistance, improve capital efficiency, and drive user and revenue growth, thereby building a better DigiLaw ecosystem.

Final Thoughts: A Call for Resonance and Dialogue

As this book delves into DigiLaws, it strives to keep things clear, accessible, and suitable for a wide audience eager to explore the crypto world in greater depth.

For the curious newcomers and observers, the book will simplify complex crypto concepts and technologies through rich case studies, helping you quickly gain a more objective and rational understanding of this rapidly evolving landscape with minimal effort.

For active participants, the book will summarize past industry patterns and the traits of projects that have thrived across bull and bear markets. It will introduce a “trust economy” perspective, helping you to identify truly valuable crypto projects based on rational analysis, rather than relying solely on “luck” “next big thing”, and “crypto dividend.”

For innovative builders, the focus is on exploring business models, providing a rapid scan of the industry, and sharing a framework and engineered intelligent solutions for designing DigiLaw ecosystems—essential lessons for every builder.

For regulators and policymakers, this book aims to offer a new understanding of the complexities of crypto and the mechanisms behind its rapid ecological evolution. By dissecting DigiLaw ecosystems, it aims to help define regulatory boundaries, enabling the crafting of comprehensive, long-term policies for a healthy, fair, and innovative digital environment.

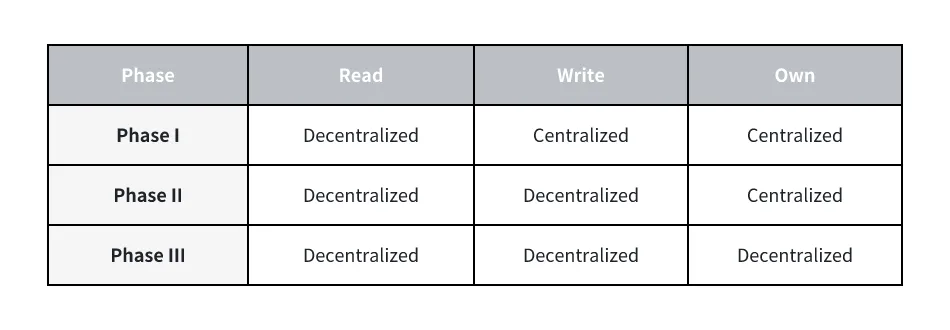

In writing this book, I plan to adopt a progressive decentralization approach, inviting everyone to participate in a “Read-Write-Own” social experiment. This experiment will unfold in three stages:

- Phase One - I will lead a small, centralized team of early participants to “Write” version 1.0 of the book, releasing it chapter by chapter for everyone to read freely.

- Phase Two - We’ll then build a community and open up the writing process. You can contribute to unfinished sections or improve on the completed parts of version 1.0. An expert team will review submissions, with successful contributors earning on-chain co-creation credits for version 2.0.

- Phase Three - Finally, we will form a DAO where participants can, alongside “Writing,” use tokens to “Own” the copyrights of co-created content and governance rights within the community. Over time, this book will evolve into a highly decentralized “public good,” iterated to version X.0 by the community.

Read-Write-Own Phases

This social experiment has two visions:

The first is to build an open community centered on DigiLaw ecosystems. This community will embody a “rational & open-source” spirit, fostering deep thinking, free exploration, and open dialogue. You will join like-minded individuals here to discuss crypto development, industry patterns, and emerging trends. Together, you’ll shape the future, expanding the community’s influence and promoting the industry’s growth.

In this community, the undecided but curious individuals and newcomers will find a space to learn, share, and grow together. Active participants can leverage tools and community power to discover high-quality projects, engage in rational discussions on DigiLaws, and gain valuable insights. Innovative builders can hone the “hard skills” needed for successful projects, potentially finding outstanding partners to collaborate and change the world together. Regulators and policymakers can explore commonalities of successful projects, engage with frontier builders, and better grasp industry trends and regulatory needs.

The second vision is to use this book as a testbed for a “Read-Write-Own” approach to content creation in progressive decentralization. The goal is to see if, with decentralization, we can rapidly create profound content and organically drive the growth of crypto education from the bottom up.

The crypto world is dynamically evolving; there are no fixed answers or conclusions. This book is an open invitation for you to explore and build this new world together, discover its true value, and establish bridges connecting technology with society, theory with practice, and the present with the future. Together, we can establish a more scientific and rigorous guide for the future direction of crypto.

This article was written by Brook, with valuable discussions and feedback from Dirk, Elaine, 0xjereme, and Joe.

This book will be released chapter by chapter in article form. For the latest updates and new chapters, please visit our website regularly.

Disclaimer: The content of this article or book is for informational purposes only and should not be considered as financial or investment advice to engage in any investment activities. It is not intended to serve as legal, accounting, or tax advice, and should not be relied upon as the basis for any investment decision. The views expressed in this article or book are those of the author and do not necessarily reflect the views of the publisher or any affiliated entities. These opinions are subject to change without notice, and the author, publisher, and distributors assume no responsibility for any losses or damages arising from the use of this content.